Cash grants and tax exemptions up to 75% can receive eligible enterprises utilizing the Development Law, for investments regarding Defense and Dual-use projects.

Types of aid

- Cash grants*

- Tax exemption

- Leasing subsidy

- Subsidy for the cost of newly created employment

*Large enterprises can receive cash grants under the Strategic/Emblematic Investments framework.

Maximum amounts

- Per enterprise and per project: EUR 20 million

- Per all associated or linked enterprises: EUR 50 million

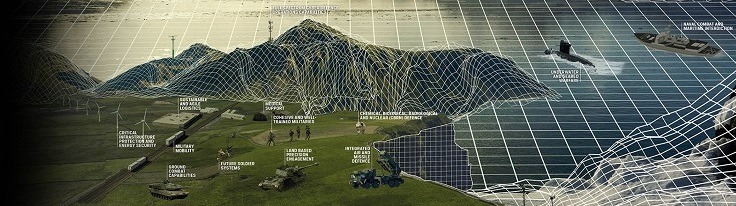

Indicative eligible activities – Defense Industry

- Manufacturing of dual-use vehicles for both civilian & military purposes

- Development of dual-use software & systems

- Manufacturing of weapons and ammunition (under conditions)

- Manufacturing of aircraft and related machinery

- Warship construction

- Manufacturing of motor vehicles

- Manufacturing of electrical and electronic equipment for motor vehicles

- Manufacturing of other parts and accessories for motor vehicles

Aid intensity

The maximum aid intensity can reach up to 75% depending on the size of the qualifying enterprise and on the area where the investment plan will be implemented.

Initial investment character

Investment plans subject to the state aid schemes must have the initial investment character and should meet one of the following conditions:

- a. Establish a new facility

- b. Expansion of the capacity of an existing facility

- c. Diversification of the output of a facility for products or services that were not previously produced in the unit (subject to conditions)

- d. Fundamental change in the overall production process of an existing facility (subject to further conditions)

Eligible expenditures

- Construction, expansion, and modernization of buildings and landscaping

- Purchase and installation of new, modern machinery and other equipment, including technical installations

- Means of transport operating within the premises of the aided unit

- Leasing payments for new, modern machinery and equipment (under conditions)

- Modernization of special facilities (not related to buildings) and mechanical installations

- Technology transfer through the acquisition of intellectual property rights, operating licenses, patents, know-how, and non-patented technical knowledge

Contact Us

For further information please contact VK PREMIUM Business Growth Consultants at : info@vkpremium.com or call us : + 30 210 6835560

* Required fields