Types of aid

- Tax exemption, grant (excluding large enterprises), leasing subsidy, and subsidy for the cost of newly created employment; and

- For SMEs, option to obtain a long-term loan guaranteed by the Hellenic Development Bank S.A. through the Development Law Guarantee Fund (DeLFI GF), or, alternatively, through another eligible financial instrument provided by the Hellenic Development Bank.

Maximum amounts

- Per enterprise and per project: EUR 20 million

- Per all associated or linked enterprises: EUR 50 million

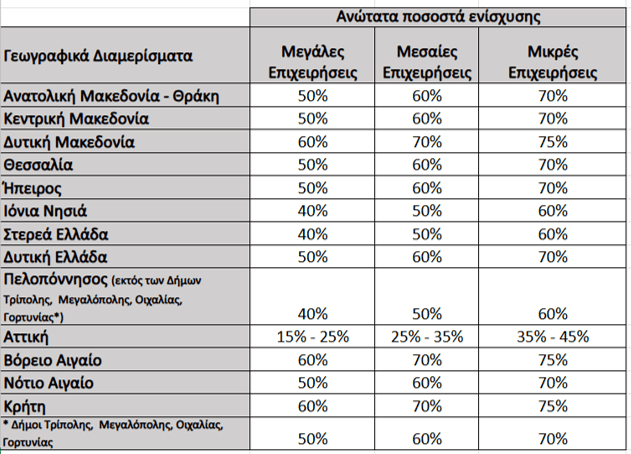

Aid Intensity

For micro, small, and medium-sized enterprises, the aid rates for all types of incentives—except for grants—are granted at the maximum aid intensity set by the regional aid map (RAM). The grant incentive is provided at 80% of the maximum RAM rate.

However, the grant incentive is provided at 100% of the maximum RAM rate for investments implemented in mountain areas, regions located within 30 kilometers of national borders, islands with a population of less than 3,100 inhabitants, and investments involving the reopening of industrial units (business facilities) that have ceased operations.

For large enterprises, all incentives are granted at 80% of the maximum RAM rate. For all special categories of investments, as mentioned above, the incentives are granted at 100% of the maximum RAM rate.

Regional Aid Map